E-commerce has transformed retail forever. Online shopping continues breaking records year after year.

This comprehensive guide covers e-commerce statistics for 2026. You'll discover market size, consumer behavior, and growth projections. Let's explore the numbers shaping digital retail.

Global E-commerce Market Overview

The e-commerce industry reaches unprecedented scale. Growth accelerates worldwide.

Market Size and Revenue

Global e-commerce performance metrics:

- Global e-commerce sales (2026): $7.4 trillion

- Growth from 2025: +11.2%

- E-commerce as percentage of total retail: 23.6%

- Projected sales by 2030: $12.1 trillion

- Online shoppers worldwide: 2.8 billion people

- Average spend per online shopper: $2,643 annually

Regional Market Distribution

E-commerce varies by geography:

| Region | Market Size 2026 | Growth Rate | Market Share |

| Asia Pacific | $4.1 trillion | 13.4% | 55.4% |

| North America | $1.5 trillion | 8.7% | 20.3% |

| Europe | $1.2 trillion | 9.2% | 16.2% |

| Latin America | $387 billion | 16.8% | 5.2% |

| Middle East & Africa | $214 billion | 19.3% | 2.9% |

Asia Pacific dominates with China driving massive volumes. Latin America and MEA show fastest growth.

Top E-commerce Markets by Country

Leading national markets:

- China: $3.2 trillion (43% of global e-commerce)

- United States: $1.3 trillion (17.6%)

- United Kingdom: $289 billion (3.9%)

- Japan: $256 billion (3.5%)

- Germany: $187 billion (2.5%)

- South Korea: $156 billion (2.1%)

- France: $142 billion (1.9%)

- India: $134 billion (1.8%)

Also read about: The Best E-commerce Scrapers in 2026🔥: Which One Wins?

E-commerce Growth Statistics

Online retail expansion continues rapidly. Multiple factors drive growth.

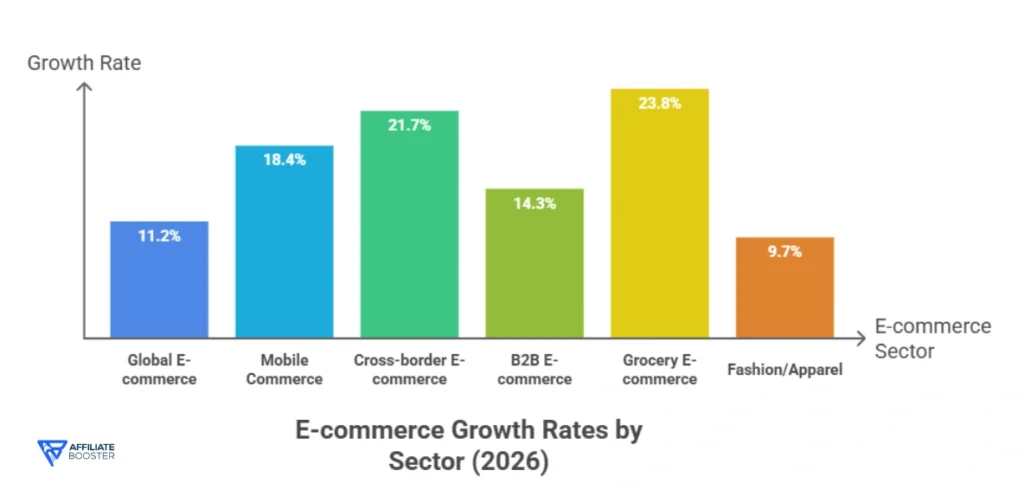

Year-over-Year Growth Rates

Annual expansion metrics:

- Global e-commerce growth (2026): 11.2%

- Mobile commerce growth: 18.4%

- Cross-border e-commerce growth: 21.7%

- B2B e-commerce growth: 14.3%

- Grocery e-commerce growth: 23.8%

- Fashion/apparel growth: 9.7%

Historical Growth Trajectory

Five-year progression:

- 2022 sales: $5.8 trillion

- 2023 sales: $6.3 trillion (+8.6%)

- 2024 sales: $6.7 trillion (+6.3%)

- 2025 sales: $6.9 trillion (+3.0% – post-pandemic normalization)

- 2026 sales: $7.4 trillion (+11.2%)

Growth rebounded after pandemic normalization slowdown in 2024-2025.

E-commerce Penetration Rate

Online shopping reaches mainstream:

- Global e-commerce penetration: 23.6% of total retail

- China penetration: 52.1%

- United States penetration: 16.4%

- United Kingdom penetration: 31.3%

- Western Europe average: 18.7%

- Expected global penetration by 2030: 31.2%

Mobile Commerce (M-commerce) Statistics

Smartphones drive e-commerce evolution. Mobile dominates online shopping.

Mobile Shopping Volume

M-commerce metrics reveal dominance:

- Global m-commerce sales (2026): $5.1 trillion

- Mobile share of e-commerce: 68.9%

- Growth rate: 18.4% year-over-year

- Mobile-only shoppers: 1.2 billion globally

- Average mobile transaction: $67

- Mobile conversion rate: 2.8% (versus 4.1% desktop)

Mobile App vs Mobile Web

Shopping method preferences:

| Shopping Method | Transaction Share | Average Order Value | Conversion Rate |

| Mobile App | 54% | $89 | 3.7% |

| Mobile Web | 46% | $58 | 2.1% |

| Desktop | 31.1% | $127 | 4.1% |

Apps outperform mobile web significantly. Desktop maintains higher order values.

Mobile Payment Methods

Payment preferences on mobile:

- Digital wallets: 56% (Apple Pay, Google Pay, PayPal)

- Credit/debit cards: 32%

- Buy Now Pay Later: 8%

- Carrier billing: 2%

- Cryptocurrency: 2%

Digital wallets dominate mobile checkout. Convenience drives adoption.

Consumer Behavior and Shopping Habits

Understanding shopper behavior reveals opportunities.

Online Shopping Frequency

How often consumers shop online:

- Shop online weekly: 47% of consumers

- Shop monthly: 34%

- Shop quarterly: 12%

- Shop rarely/annually: 7%

- Average purchases per shopper annually: 42 transactions

- Average monthly online spend: $220

Product Categories Performance

What sells best online:

| Category | Market Size 2026 | Growth Rate | Online Penetration |

| Fashion & Apparel | $1.2 trillion | 9.7% | 38% |

| Electronics | $987 billion | 8.3% | 42% |

| Food & Beverage | $624 billion | 23.8% | 12% |

| Beauty & Personal Care | $478 billion | 14.2% | 27% |

| Home & Garden | $412 billion | 11.4% | 19% |

| Toys & Hobbies | $287 billion | 13.6% | 34% |

| Books & Media | $234 billion | 6.2% | 67% |

| Health & Wellness | $198 billion | 18.7% | 21% |

Food & beverage shows explosive growth. Books maintain highest penetration.

Shopping Cart Abandonment

Major conversion challenge:

- Average cart abandonment rate: 70.2%

- Mobile abandonment rate: 85.6%

- Desktop abandonment rate: 73.1%

- Tablet abandonment rate: 80.4%

- Value of abandoned carts (2025): $5.2 trillion

- Recoverable abandonment: 63% with proper follow-up

Reasons for Cart Abandonment

Why shoppers don't complete purchases:

- Unexpected shipping costs: 48%

- Required account creation: 24%

- Complicated checkout process: 17%

- Concerns about payment security: 16%

- Long delivery times: 14%

- Website errors/crashes: 13%

- Just browsing/comparing prices: 37%

Demographics and User Statistics

E-commerce adoption varies by demographics.

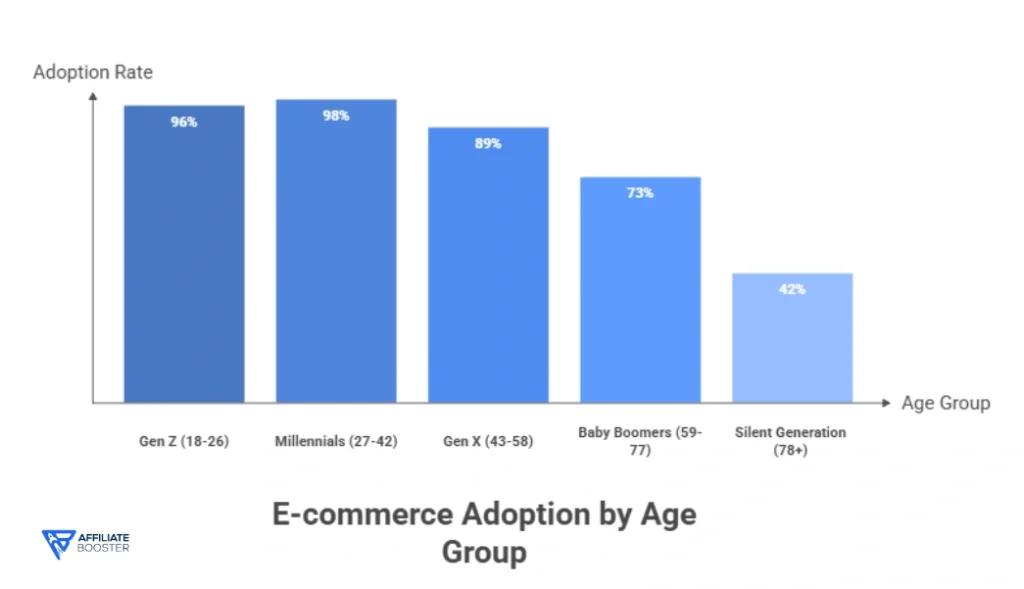

Age Distribution

Shopping habits by generation:

- Gen Z (18-26): 96% shop online, average spend $1,847/year

- Millennials (27-42): 98% shop online, average spend $3,124/year

- Gen X (43-58): 89% shop online, average spend $2,987/year

- Baby Boomers (59-77): 73% shop online, average spend $2,156/year

- Silent Generation (78+): 42% shop online, average spend $1,234/year

Millennials lead in both adoption and spending. Gen Z grows fastest.

Gender Shopping Patterns

Male versus female behavior:

- Female shoppers: 51% of online buyers, average spend $2,834/year

- Male shoppers: 49% of online buyers, average spend $2,447/year

- Women prefer: Fashion, beauty, home goods

- Men prefer: Electronics, automotive, sports equipment

- Women shop more frequently: 47 purchases/year versus men's 37

- Men have higher average order value: $73 versus women's $61

Income Level Impact

Spending correlates with income:

- Household income $100K+: $4,567 average annual spend

- $75K-$100K: $3,234

- $50K-$75K: $2,456

- $35K-$50K: $1,789

- Under $35K: $1,123

- High-income shoppers purchase 2.3x more frequently

Social Commerce Statistics

Social media drives purchasing decisions. Platforms become marketplaces.

Social Shopping Market Size

Social commerce grows explosively:

- Global social commerce sales (2026): $2.1 trillion

- Growth rate: 27.4% year-over-year

- Share of total e-commerce: 28.4%

- Social commerce shoppers: 1.4 billion globally

- Average purchase via social: $87

Platform Performance

Where social shopping happens:

| Platform | Users Shopping | Sales Volume 2026 | Dominant Category |

| TikTok Shop | 780 million | $624 billion | Fashion, beauty |

| Facebook/Instagram | 890 million | $542 billion | Various |

| 340 million | $287 billion | Home, fashion | |

| YouTube Shopping | 420 million | $198 billion | Electronics |

| Snapchat | 156 million | $67 billion | Fashion, beauty |

TikTok Shop dominates growth with integrated shopping experience.

Influencer Marketing Impact

Creator-driven commerce:

- Consumers who purchased via influencer recommendation: 68%

- Average influencer-driven purchase: $134

- Influencer marketing ROI: $5.78 per dollar spent

- Brands using influencer commerce: 79%

- Micro-influencer effectiveness: 87% higher than celebrities

Also read about: Influencer Marketing Statistics

Cross-Border E-commerce

International shopping removes barriers. Global marketplaces thrive.

Cross-Border Market Size

International e-commerce volumes:

- Cross-border e-commerce sales (2026): $1.8 trillion

- Growth rate: 21.7% year-over-year

- Share of total e-commerce: 24.3%

- Cross-border shoppers: 1.1 billion

- Average cross-border transaction: $156

Popular Cross-Border Routes

Major international shopping flows:

- China to USA: $287 billion

- China to Europe: $234 billion

- USA to Canada: $89 billion

- UK to Europe: $67 billion

- Europe to USA: $54 billion

China dominates exports. Western markets import heavily.

Cross-Border Challenges

Barriers to international shopping:

- High shipping costs: Cited by 64% of shoppers

- Long delivery times: 58%

- Customs/import fees: 47%

- Product returns difficulty: 43%

- Currency conversion concerns: 31%

- Language barriers: 28%

Payment Method Statistics

How consumers pay online evolves rapidly.

Payment Preferences

Checkout method distribution:

| Payment Method | Usage Share | Growth Rate | Preferred By |

| Digital Wallets | 49% | +18% | Millennials, Gen Z |

| Credit Cards | 23% | -3% | Gen X, Boomers |

| Debit Cards | 14% | +2% | All demographics |

| Buy Now Pay Later | 8% | +67% | Gen Z, Millennials |

| Bank Transfer | 4% | +12% | Europe, Asia |

| Cash on Delivery | 2% | -8% | Developing markets |

Digital wallets now dominate globally. BNPL grows explosively.

Top Digital Wallet Providers

Leading payment platforms:

- PayPal: 429 million active users globally

- Apple Pay: 507 million users

- Google Pay: 400 million users

- Alipay: 1.3 billion users (China-focused)

- WeChat Pay: 900 million users (China-focused)

Buy Now Pay Later Adoption

Installment payment explosion:

- BNPL transaction volume (2026): $680 billion

- Growth rate: 67% year-over-year

- BNPL users globally: 420 million

- Average BNPL purchase: $187

- Repeat usage rate: 73%

- Default rate: 6.8%

Leading BNPL providers: Klarna, Afterpay, Affirm, PayPal Pay in 4

Conversion Rate Optimization

Improving sales efficiency matters tremendously.

Average Conversion Rates

Industry benchmark metrics:

- Global e-commerce conversion rate: 2.86%

- Desktop conversion rate: 4.14%

- Mobile conversion rate: 2.82%

- Tablet conversion rate: 3.49%

- Top 10% of sites: 11.2%+ conversion rate

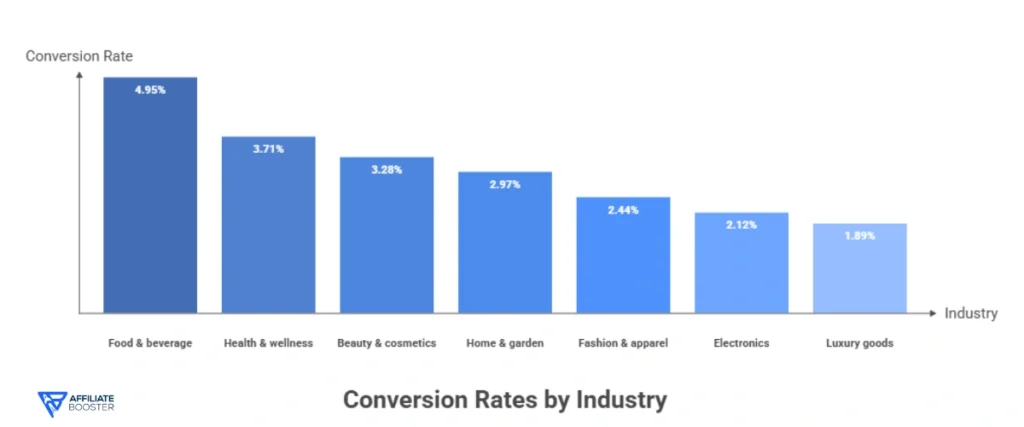

Conversion Rate by Industry

Sector performance varies:

- Food & beverage: 4.95%

- Health & wellness: 3.71%

- Beauty & cosmetics: 3.28%

- Home & garden: 2.97%

- Fashion & apparel: 2.44%

- Electronics: 2.12%

- Luxury goods: 1.89%

Higher-frequency purchases convert better. Luxury requires more consideration.

Factors Impacting Conversion

What drives or kills sales:

Positive Impact:

- Free shipping: +28% conversion

- Customer reviews: +18%

- Live chat support: +12%

- Multiple payment options: +9%

- Clear return policy: +7%

Negative Impact:

- Slow page load (3+ seconds): -32% conversion

- Forced account creation: -24%

- Hidden costs at checkout: -21%

- Poor mobile experience: -18%

Customer Acquisition and Retention

Getting and keeping customers drives profitability.

Customer Acquisition Cost (CAC)

Average costs to acquire buyers:

- E-commerce average CAC: $45

- Fashion/apparel: $129

- Electronics: $87

- Beauty/cosmetics: $67

- Food/beverage: $38

- Paid social media CAC: $52

- Paid search CAC: $41

- Email marketing CAC: $12

Customer Lifetime Value

Long-term customer worth:

- Average CLV: $168 (all industries)

- Fashion loyal customer CLV: $478

- Electronics CLV: $387

- Beauty subscription CLV: $562

- CLV:CAC ratio (healthy): 3:1 or higher

- Top performers achieve: 8:1 ratio

Repeat Purchase Rates

Customer loyalty metrics:

- Customers who make repeat purchase: 32%

- Within first 30 days: 18%

- Within 90 days: 44%

- Average orders per customer annually: 3.2

- Repeat customer revenue share: 43%

- Repeat customer profit margin: 67% higher

Shipping and Delivery Statistics

Fulfillment expectations shape shopping behavior.

Shipping Speed Expectations

Consumer delivery preferences:

- Expect free shipping: 80% of shoppers

- Willing to wait 3-5 days for free shipping: 68%

- Will pay for same-day delivery: 23%

- Abandon cart due to shipping costs: 48%

- Consider shipping speed in purchase decision: 76%

Delivery Options Performance

Fulfillment method distribution:

| Delivery Method | Usage Rate | Average Cost | Customer Satisfaction |

| Standard (3-5 days) | 62% | $4.95 | 78% |

| Expedited (2-3 days) | 23% | $12.99 | 84% |

| Next-Day | 9% | $19.99 | 91% |

| Same-Day | 4% | $24.99 | 93% |

| In-Store/Curbside Pickup | 2% | Free | 89% |

Faster delivery correlates with higher satisfaction despite cost.

Free Shipping Impact

Zero-cost delivery drives behavior:

- Shoppers who expect free shipping: 80%

- Minimum purchase for free shipping: Average $50

- Revenue increase with free shipping: +20%

- Cart size increase to qualify: +35%

- Conversion rate lift: +28%

Return and Refund Statistics

Product returns challenge e-commerce profitability.

Return Rate Data

How often products come back:

- Average e-commerce return rate: 20.8%

- Fashion/apparel: 40%

- Electronics: 11%

- Home goods: 18%

- Beauty products: 7%

- Shoes: 45%

- Total returns value (2025): $890 billion

Return Policy Impact

Liberal policies drive sales:

- Shoppers who check return policy before buying: 67%

- Prefer 30+ day return window: 73%

- More likely to buy with free returns: 58%

- Revenue increase with free returns: +15%

- Repeat purchase rate with easy returns: +34%

Return Fraud

Dishonest returns hurt margins:

- Return fraud rate: 10.6% of all returns

- Most common fraud: “Wardrobing” (wearing then returning)

- Annual return fraud cost: $94 billion

- Businesses implementing stricter policies: 64%

Future E-commerce Trends

Emerging technologies reshape online shopping.

Voice Commerce Growth

Shopping via voice assistants:

- Voice commerce sales (2026): $164 billion

- Growth rate: 34% year-over-year

- Voice shoppers: 189 million

- Most purchased via voice: Groceries, household items

- Amazon Alexa dominates: 71% of voice commerce

Augmented Reality (AR) Shopping

Virtual try-on technology:

- Retailers offering AR: 34% (up from 12% in 2023)

- AR product visualization adoption: 67% reduction in returns

- Conversion rate lift with AR: 94%

- Beauty/cosmetics AR usage: 78% of apps

- Furniture AR adoption: 56% of major retailers

AI and Personalization

Artificial intelligence powers experiences:

- Retailers using AI personalization: 81%

- Revenue increase from personalization: 10-30%

- Product recommendation accuracy: 89%

- Chatbot customer service: 85% of interactions

- AI-generated product descriptions: 43% of listings

FAQs About e-Commerce Statistics

Also Read About:

- Apple Music Statistics

- Zoom Statistics

- ChatGPT Statistics

- Perplexity AI Statistics

- Meta AI Users Statistics

Conclusion

E-commerce reached $7.4 trillion in 2026, capturing 23.6% of global retail. Mobile dominates at 68.9% of transactions, while social commerce and BNPL payment methods surge.

Consumer expectations for free shipping, easy returns, and personalized experiences continue rising, driving innovation across the industry.