Amazon Music has grown into a major streaming platform. It competes with Spotify, Apple Music, and YouTube Music for listener attention.

This comprehensive guide covers Amazon Music statistics for 2026. You'll discover subscriber counts, revenue data, and user behavior patterns.

Let's explore the numbers behind this streaming giant.

Amazon Music Market Overview

Amazon Music represents a significant player in music streaming. The platform leverages Amazon's massive ecosystem.

Subscriber Count and Growth

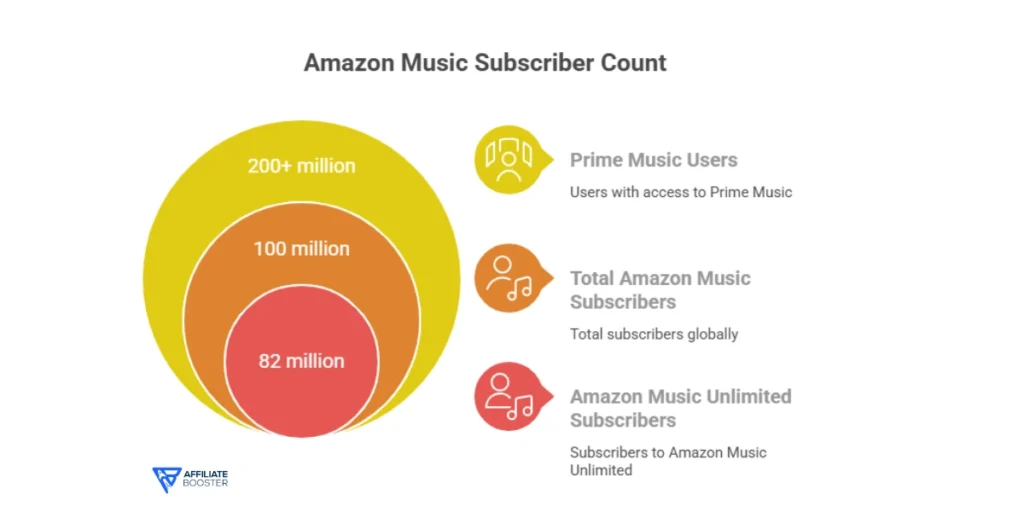

Amazon Music continues expanding its user base:

- Total Amazon Music subscribers: 100 million globally (2026)

- Amazon Music Unlimited subscribers: 82 million

- Prime Music users (included with Prime): 200+ million with access

- Growth rate: 15% year-over-year

- Added 13 million new subscribers in 2025

Market Share Statistics

Amazon Music claims a solid market position:

| Platform | Global Market Share | Subscribers | Revenue 2026 |

| Spotify | 31% | 626 million | $15.7 billion |

| Apple Music | 15% | 88 million | $8.9 billion |

| Amazon Music | 13% | 100 million | $7.2 billion |

| YouTube Music | 11% | 80 million | $6.3 billion |

| Tencent Music | 10% | 657 million | $5.8 billion |

| Others | 20% | Various | $12.1 billion |

Amazon Music holds the third-largest market share globally. The platform grows steadily despite intense competition.

Geographic Distribution

Amazon Music availability spans worldwide:

- Available in 100+ countries

- Strongest presence in United States: 45 million subscribers

- UK subscribers: 12 million

- Germany: 8 million

- Japan: 7 million

- India: 11 million (fastest growing market)

- Canada: 5 million

- France: 4 million

Also read about: Amazon Affiliate Program

Revenue and Financial Performance

Amazon Music generates substantial revenue. The streaming service contributes to Amazon's services division.

Revenue Breakdown

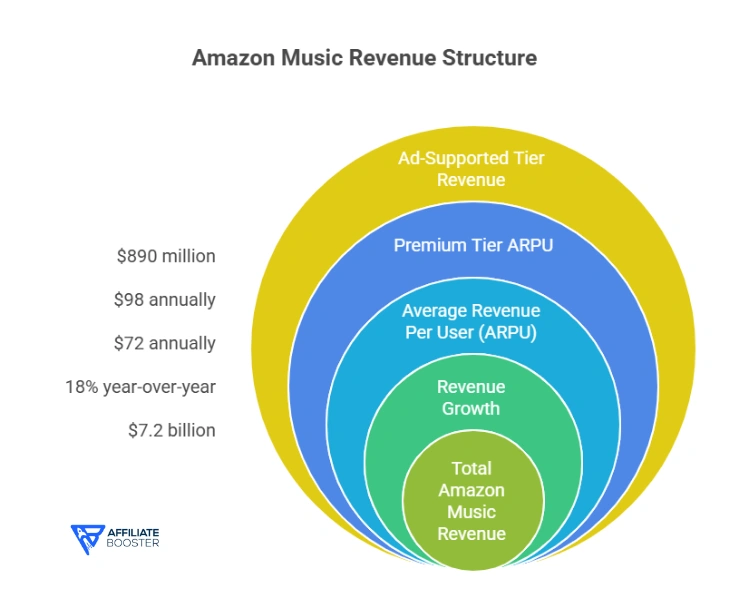

Financial performance shows steady growth:

- Total Amazon Music revenue (2026): $7.2 billion

- Revenue growth: 18% year-over-year

- Average revenue per user (ARPU): $72 annually

- Premium tier ARPU: $98 annually

- Ad-supported tier revenue: $890 million

Subscription Pricing

Amazon offers multiple pricing tiers:

| Plan Type | Monthly Price | Annual Price | Features |

| Prime Music | Included | Included with Prime | 2M+ songs, ad-free |

| Music Unlimited (Prime) | $9.99 | $99 | 100M+ songs, HD |

| Music Unlimited (Non-Prime) | $10.99 | $109 | 100M+ songs, HD |

| Student Plan | $5.99 | N/A | Full Unlimited access |

| Family Plan | $16.99 | $169 | Up to 6 accounts |

| Single Device | $4.99 | N/A | Echo/Fire TV only |

Prime Bundle Advantage

Amazon Prime integration drives adoption:

- 78% of Amazon Music subscribers also have Prime membership

- Prime Music included for all 230+ million Prime members

- Conversion rate from Prime Music to Unlimited: 36%

- Bundle creates significant value perception

Also read about: 9 Best Proxies For Amazon in 2026 🏅Our #1 Pick!

Content Library Statistics

Amazon Music offers extensive catalogs. The library continues expanding.

Music Catalog Size

Content availability grows constantly:

- Total songs available: 100+ million tracks

- Prime Music catalog: 2 million songs (curated selection)

- Podcasts available: 10+ million episodes

- Audiobooks integration: 1 million+ titles (via Audible)

- New releases added daily: 60,000+ tracks

Audio Quality Options

Amazon provides various quality tiers:

- Standard quality: 320 kbps (most common)

- HD (High Definition): 850 kbps lossless audio

- Ultra HD: 3730 kbps (24-bit/192 kHz)

- Spatial Audio tracks: 7+ million songs

- Dolby Atmos content: Millions of tracks

Exclusive Content

Amazon Music creates original programming:

- Original podcast series: 500+ shows

- Exclusive artist collaborations: 1,200+ releases

- Live concert recordings: 3,500+ performances

- Artist documentaries: 200+ films

- Exclusive early releases: 150+ albums annually

Also read about: How to Earn Money from Amazon? 13 Proven and Tested Ways

User Behavior and Engagement

Understanding how listeners use Amazon Music reveals important patterns.

Listening Time Statistics

Users spend significant time streaming:

- Average listening time per user: 23 hours monthly

- Daily active users: 42% of subscriber base

- Peak listening hours: 6 PM – 10 PM

- Weekend listening up 31% versus weekdays

- Average session length: 47 minutes

Device Usage Breakdown

Amazon Music works across multiple devices:

| Device Type | Usage Percentage | Growth Rate |

| Echo/Alexa Devices | 47% | 8% |

| Mobile Apps (iOS/Android) | 38% | 12% |

| Desktop/Web Player | 9% | -3% |

| Fire TV | 4% | 15% |

| Automotive | 2% | 34% |

Echo and Alexa devices dominate usage. Mobile apps show strong growth. Automotive integration grows rapidly.

Voice Command Statistics

Alexa integration drives unique behavior:

- 67% of Echo users stream music via voice commands

- “Alexa, play music” requested 2.3 billion times in 2025

- Voice-initiated sessions average 62 minutes (longer than manual)

- 54% of users discover new music through Alexa recommendations

- Voice shopping for music: $420 million in purchases

Popular Music Genres and Artists

Listening preferences reveal trends. Amazon Music tracks popular content carefully.

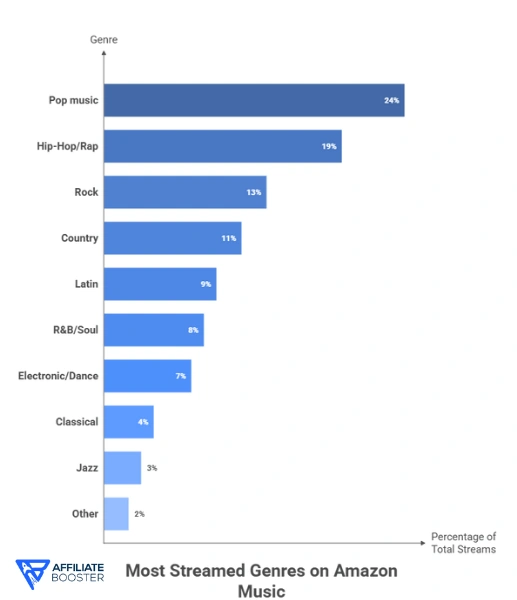

Most Streamed Genres

Genre popularity on Amazon Music:

- Pop music: 24% of total streams

- Hip-Hop/Rap: 19%

- Rock: 13%

- Country: 11%

- Latin: 9%

- R&B/Soul: 8%

- Electronic/Dance: 7%

- Classical: 4%

- Jazz: 3%

- Other: 2%

Regional Genre Preferences

Music tastes vary by location:

United States

- Country music over-indexes by 340%

- Hip-Hop strong in urban markets

- Classic rock popular among 40+ demographic

United Kingdom

- British pop and indie rock lead

- Electronic music strong growth

- Grime and UK rap emerging

India

- Bollywood dominates with 67% of streams

- Classical Indian music: 18%

- Western pop growing among youth

Latin America

- Reggaeton leads streaming

- Regional Mexican music strong

- Latin pop growing 28% annually

Playlist Usage Statistics

Playlists drive discovery and engagement:

- 89% of users listen to playlists regularly

- Average playlists saved per user: 37

- Curated playlists available: 50,000+

- Most popular playlist category: Workout/Fitness

- User-created playlists: 850 million

Amazon Music vs Competitors

Understanding competitive positioning reveals strengths and weaknesses.

Feature Comparison

How Amazon Music stacks up:

| Feature | Amazon Music | Spotify | Apple Music |

| Free Tier | Prime Music | Yes | No |

| Song Library | 100M+ | 100M+ | 100M+ |

| Audio Quality | Up to Ultra HD | Up to 320 kbps | Lossless |

| Spatial Audio | Yes (Dolby Atmos) | Limited | Yes (Spatial) |

| Podcasts | 10M+ episodes | 5M+ episodes | Limited |

| Voice Integration | Alexa (native) | Third-party | Siri |

| Offline Downloads | Yes | Yes | Yes |

| Family Plan Price | $16.99 | $16.99 | $16.99 |

| Student Discount | 40% | 50% | 50% |

User Satisfaction Scores

Customer satisfaction metrics:

- Overall satisfaction rating: 4.2/5 stars

- App Store rating (iOS): 4.6/5

- Google Play rating (Android): 4.3/5

- Sound quality satisfaction: 87%

- App usability: 79%

- Customer support: 72%

- Value for money: 84%

Churn Rate Comparison

Subscriber retention varies by platform:

- Amazon Music churn rate: 5.8% monthly

- Spotify churn rate: 4.2% monthly

- Apple Music churn rate: 4.9% monthly

- Amazon Prime bundling reduces churn by 38%

- Family plan subscribers churn 67% less than individual subscribers

Podcast and Audiobook Integration

Amazon Music expands beyond music. Audio content diversifies offerings.

Podcast Statistics

Podcasts gain prominence on the platform:

- Total podcast episodes: 10+ million

- Original Amazon podcasts: 500+ shows

- Podcast listeners: 34% of Amazon Music users

- Average podcast consumption: 6.2 hours monthly per listener

- Top podcast categories: True Crime, News, Comedy, Business

Audiobook Integration

Audible integration creates synergy:

- Audiobooks available through Music app: 1+ million titles

- Premium Plus subscribers get audiobook credits

- Audiobook listening growth: 43% year-over-year

- 23% of Music Unlimited subscribers also have Audible

- Cross-promotion drives $780 million in additional revenue

Artist and Creator Statistics

Amazon Music supports creators. The platform offers various monetization options.

Artist Payments

Creator economics on Amazon Music:

- Average per-stream payout: $0.004 (higher than Spotify's $0.003)

- Total artist payouts (2025): $2.8 billion

- Artists on platform: 8+ million

- Independent artists: 73% of catalog

- Artist payment growth: 22% year-over-year

Amazon Music for Artists

Creator tools and analytics:

- Artists with access to analytics dashboard: 500,000+

- Data points tracked: Streams, demographics, playlisting

- Artist verification program participants: 120,000

- Direct fan engagement tools launched 2024

Emerging Artist Program

Amazon supports new talent:

- Emerging artist grants distributed: $15 million annually

- Artists supported through Breakthrough program: 2,500+

- Average playlist placement boost: 340% increase in streams

- 67% of emerging artists report increased income

Technology and Innovation

Amazon Music invests in cutting-edge technology. Innovation drives competitive advantage.

AI and Machine Learning

Artificial intelligence powers recommendations:

- Personalized playlists generated: 2.3 billion annually

- AI recommendation accuracy: 89% user satisfaction

- Machine learning models analyze 15+ billion data points daily

- Voice recognition accuracy: 96% for music requests

- Auto-generated radio stations: 100,000+ available

Spatial Audio Adoption

3D audio technology gains traction:

- Songs available in Dolby Atmos: Millions

- Spatial Audio listeners: 47% of Unlimited subscribers

- Compatible devices: Echo Studio, Fire TV, headphones

- Spatial Audio streams grew 156% in 2025

- User satisfaction with spatial audio: 92%

Automotive Integration

Car connectivity expands reach:

- Vehicles with Amazon Music integration: 45+ million

- Automotive manufacturers partnered: 28 brands

- In-car listening sessions: 2% of total streams (growing rapidly)

- Automotive tier growth rate: 34% annually

- Mercedes-Benz, BMW, Ford lead integration

Demographics and User Profile

Understanding the Amazon Music audience reveals targeting opportunities.

Age Distribution

Age breakdown of subscribers:

| Age Group | Percentage | Preferred Content |

| 13-17 | 8% | Pop, Hip-Hop |

| 18-24 | 23% | Hip-Hop, EDM |

| 25-34 | 31% | Pop, Rock, Indie |

| 35-44 | 22% | Rock, Country, Pop |

| 45-54 | 11% | Classic Rock, Country |

| 55+ | 5% | Classical, Jazz, Oldies |

The 25-34 demographic dominates. This aligns with Prime membership concentration.

Gender Distribution

Listener breakdown by gender:

- Male listeners: 54%

- Female listeners: 45%

- Non-binary/Other: 1%

- Genre preferences vary significantly by gender

- Women prefer Pop and Country by 18% margin

- Men prefer Hip-Hop and Rock by 23% margin

Income and Education

Subscriber demographics lean affluent:

- Household income $75K+: 68% of paid subscribers

- College educated: 71%

- Prime membership correlation: Strong positive

- Family plan subscribers average income: $94,000

- Higher income users prefer Unlimited over Prime Music

Mobile App Performance

The Amazon Music app drives significant engagement. Mobile represents the future.

App Downloads and Usage

Mobile app statistics reveal strong adoption:

- Total app downloads: 400+ million (lifetime)

- Monthly active users (mobile): 58 million

- iOS app downloads: 45% of total

- Android app downloads: 55% of total

- Average app session duration: 47 minutes

- Daily app opens per user: 3.2 times

App Features and Functionality

Key app capabilities:

- Offline download capacity: Unlimited (for paid tiers)

- Cross-device sync: Real-time across all devices

- Lyrics integration: Available for 85% of songs

- Car mode interface: Dedicated UI for drivers

- Widget support: Home screen controls

App Performance Metrics

Technical performance data:

- App crash rate: 0.8% (industry average 2.5%)

- Average load time: 1.4 seconds

- Battery consumption: Moderate (similar to competitors)

- Data usage (streaming): 2 MB per minute (standard quality)

- Offline mode usage: 34% of listening time

Future Trends and Predictions

Amazon Music faces an evolving landscape. Several trends will shape the platform.

Market Growth Projections

Expected expansion through 2028:

- Projected subscribers by 2028: 145 million

- Compound annual growth rate: 13.8%

- Expected market share by 2028: 15%

- Revenue projection 2028: $11.4 billion

- Emerging markets will drive 60% of growth

Technology Roadmap

Anticipated innovations:

- Enhanced AI recommendations: Emotion-based playlisting

- Virtual reality concerts: Launch expected 2026

- Blockchain-based artist payments: Testing phase

- Ultra-personalized radio: Individual user stations

- Social features expansion: Collaborative playlists, sharing

Competitive Strategy

Amazon's positioning evolves:

- Deeper Prime integration: More exclusive benefits

- Original content investment: $500 million annually

- International expansion: 20 new markets by 2027

- Smart home dominance: Leverage Echo ecosystem

- Bundling with other Amazon services

FAQs About SaaS Statistics

Also Read About:

- Apple Music Statistics

- Zoom Statistics

- ChatGPT Statistics

- Perplexity AI Statistics

- Meta AI Users Statistics

Conclusion

Amazon Music reached 100 million subscribers in 2026, holding 13% of the global market. It ranks third behind Spotify and Apple Music, with $7.2 billion in revenue, growing 18% YoY.

The platform offers over 100 million songs, including Ultra HD and Dolby Atmos audio. Voice integration with Alexa drives 47% of listening on Echo devices, leading to longer, engaged sessions.

Artists earn $0.004 per stream, with $2.8 billion paid out in 2025. Amazon Music’s future looks promising with a projected 145 million subscribers by 2028, driven by international growth, original content, and innovation.

Amazon Music offers great value for Prime members, Alexa users, and audiophiles. It’s a strong, growing platform in the competitive streaming landscape.

Source: Business of Apps, Statista